There’s a lot of interest in building renovation and urban renewal in 2020. You only need to turn on your television to witness this significant and expanding market trend in action. Historic preservation is great for television ratings. It’s even greater for real estate developers, urban planners and local residents. In 1976, the federal government recognized the need to preserve our historic buildings and put in place programs to protect them. The Federal Historic Preservation Tax Incentives Program (HTC) is one such program. It gives real estate developers a path to certification for historic buildings. Once certified, this program also qualifies buildings for a little help with tax incentives.

The historic record of historic preservation efforts and tax incentives

HTC is a joint effort between the National Park Service and the Internal Revenue Service. The agencies work in partnership with State Historic Preservation Offices. Currently, interested parties can find HTC offices in 37 states. Approved buildings may receive up to 20 percent in tax incentives for qualified urban-revitalization projects.

The National Park Service has used private investments to fund projects for forty years. Today that totals north of $96.87 billion. They have supported the restoration and preservation of over 44,341 historic properties. Besides preserving history, the program provides jobs and improves the quality of life.

Recently, Rutgers University’s Center for Urban Policy Research conducted a study. Researchers found HTC contributed over $12.2 billion in output goods and services. It also added $6.2 billion to the gross domestic product. That was for the fiscal year 2017 alone. These programs are good for everyone.

Step One: historic preservation certifications

To qualify for a historic preservation certificate and the potential tax incentives, historic buildings must either

- appear on the National Register of Historic Places

- have historic certifications they “contribute to the significance” of their respective “registered historic district.”

Further, buildings may list as either individual entities or as a part of a larger historic district.

Your building may already be listed. To verify its status, contact your local historic district commission, municipal planning office, or State Historic Preservation Office (SHPO).

Once your property appears in a National Register district or a certified state or local district, it then must be designated by the National Park Service as a structure retaining both historic integrity and contributing to the historic character of its neighborhood.

Once these qualifications are met, the building qualifies as a “certified historic structure.”

The Definition of Contributing

A “contributing” structure is usually associated with a particular time period or “period of significance.” This might be an Arts and Crafts or an Art Deco style building. In a district recognized for Arts and Crafts, a 1950s office building does not contribute to the overall district aesthetic and is therefore ineligible for the 20% rehabilitation tax credit.

To request the National Park Service designation for your building of “certified historic structure,” you can complete and submit the Historic Preservation Certification Application, part one.

Explore the application process.

Step Two: pass the “substantial rehabilitation test”

That means that within two years, the cost of rehabilitating the property must exceed the pre-rehabilitation cost of the building. Further, that window may be extended to five years if the project expands to different phases.

A historic preservation project cost must exceed the greater of either the building’s adjusted basis or $5,000.

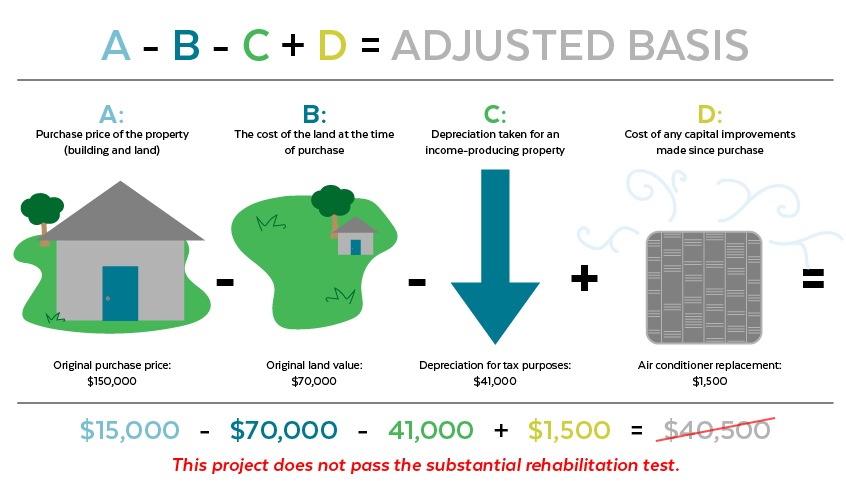

The National Park Service outlines the following formula to determine if your project will be substantial:

- A – B – C + D = adjusted basis

- A = purchase price of the property (building and land)

- B = the cost of the land at the time of purchase

- C = depreciation taken for an income-producing property

- D = cost of any capital improvements made since purchase

EXAMPLE: a landlord owns a small Arts and Crafts rental cottage.

- Original purchase price $150,000 [building and land]

- Original land value $70,000

- Depreciation for tax purposes $41,000

- Air conditioner replacement $1,500

The adjusted basis for this project is $40,500 (or 150,000 – 70,000 – 41,000 + 1,500). This project does not pass the substantial rehabilitation test.

Here is a project that does. The landlord allocates $50,000 for the following:

Here is a project that does. The landlord allocates $50,000 for the following:

- new roof

- repair rotten siding

- wiring upgrade

- rebuild the front porch.

To ensure eligibility, the owner must first complete the following:

- the application process for historic structure certification

- once he or she receives the certification from the National Park Service, the landlord must confirm that the rehabilitation meets the Secretary of the Interior’s Standards for Rehabilitation

The owner will be eligible for a 20% credit on the cost of his rehabilitation, or a $10,000 credit of the $50,000 allocated.

Expenses that may not qualify for the tax credit are things like a new rear addition, new kitchen appliances, and landscaping.

Explore this list of qualified and non-qualified expenses from the National Park Service.

NOTE: The National Park Service strongly advises those looking to certify and receive tax credits on their historic property enlist the services of an attorney.

Step Three: do the actual rehabilitation according to the Secretary of the Interior’s Standards

These standards are intended to retain as much of the original structure and character of the building as possible. There is a balance to this principle. Builders are encouraged to use common sense and seek advice from your local State Historic Preservation Office or your attorney to help you safely navigate these decisions. If you follow the example above of the rental cottage, it’s common sense that a modern HVAC system and smart home features can be integrated for tenant comfort with little or no impact on historic details while allowing the landlord a competitive advantage against other rental properties in the area.

Apply standards to projects in a reasonable manner, taking into consideration economic and technical feasibility.

Visit the Secretary of the Interior’s Standards for Rehabilitation page.

Step Four: produce income from the post-rehabilitation historic building for five years minimum

Private residential properties that are owner-occupied do not qualify for the 20 percent federal rehabilitation tax credit.

Properties must be rehabilitated for income-producing purposes. This includes commercial, industrial, agricultural, rental residential or apartment use.

“If a portion of a personal residence is used for business, such as an office or a rental apartment, in some instances the amount of rehabilitation costs spent on that portion of the residence may be eligible for the credit.”

Visit the National Park Services program eligibility page to find a more complete list of qualifying factors.

New Technology and Historic Properties

Introducing new systems or features may be necessary to meet the reasonable needs of potential tenants. Changes can usually be made in ways that are sympathetic to the existing structure and site.

The National Park Services website gives examples of new technologies external to a historic building: solar panels, green roofs and wind turbines.

The Historic Sinclair Hotel (Fort Worth, Texas)

Versa Technology was proud to participate in the renovation of the Sinclair Hotel in Ft. Worth, TX. Using the latest in High Power PoE equipment, the developers were able to use the existing cabling conduit to deliver state of the art smart building technologies in the constraints of a structure built in 1929.

Visit our products page to learn more about Versa Technologies Power over Ethernet (PoE) switches, hubs and top tier last-mile equipment.